"There is a misunderstanding of what is happening. A bond issue is borrowing. The school district sells the bonds, receives the money up front and agrees to pay the money back over time with interest. The bond issue that is expiring made the payments on the loan we took out to build the high school. The high school is paid for. This bond issue is going to be used to fund operations and maintenance. The school district is going to get that money up front and is going... to have to pay the interest on it over the term of the bond- 15 years or 30 or whatever. All the busses aren’t going to be purchased at once. In the last bond scheme 16 bus purchases where spread over 11 years but the interest on the last bus purchased started accruing as soon as the bonds were sold. That put the interest cost for that last bus over $48,000 before a kid ever sat in it. This is like a family that doesn’t have enough cash to go to McDonalds but decides to go to the steakhouse because they can use the credit card. After all it’s for the kids. Right? Wrong. It’s shortsighted and is going to lead to bigger trouble down the road. If the population and along with it the school enrollment continues to drop property values will decline. Revenue to the school will continue to fall and in the end the school won’t be able to make the bond payments. A sinking fund is used to pay for major repairs. It is of short duration and will not have the interest costs or management costs associated with a bond issue. Sinking fund money can be used to repair the roofs and repave the parking lots instead of using money from the general fund. This will give the board a little breathing room to get the operating costs in line with the student population."

~ Bill Lang

There will be a ballot question given to the voters of the Beaverton Rural Scool District to see if they can justify extending the construction bond that requires 2.8 mills for principle and interest and is set to expire in 2015.

The language will be coming out shortly so this posting is a bit premature, as some facts and figures that are currently absent. Just keep in mind that the request is coming and it's not a bad time to review some not so distant history in regards to local school funding requests.

Bonds are a long term funding obligation. While the school gets all the money up front, the tax payers get the long term tax burden.

We should be reminded that tying maintenance items to long term financing may save short term general fund dollars, but it is not saving us anything, on the contrary, It is going to cost us more to maintain our investment in the school infrastructure.

Any long term funding obligations should be scrutinized. Currently, the tax base continues to erode, enrollment continues to decline, and local economic activity is not projected to see any measurable increase short of EDC manipulation that has never proved any long term positive effect.

Many Schools have turned to sinking funds as a way to locally fund infrastructure repairs.

while existing law limits the use of such funds to the purchase of real estate and the construction or repair of school buildings., the positive aspect is the local dollars go directly from us to the school. No borrowing, No interest, and written properly, no long term obligations.

"A sinking fund millage is a limited property tax, considered a pay-as-you-go method, for addressing building remodeling projects. State law allows a district to levy up to five mills, for no longer than 20 years. It is more like a bank account where you can access the money on-hand to pay for projects as they are completed. The district will not be paying interest for the money used. The State of Michigan has legal requirements, restrictions and guidelines for public school districts that plan to fund capital enhancements or facility repairs through sinking fund millage levies."

There is also legislation working through that I don't disagree with. Allowing voters in a district to approve sinking fund millages without limitation on what the funds are to be used for. I would just expect that each request that is approved, be utilized in a manner consistent with the original request.

http://votesmart.org/bill/8554/23157/38351/bill-huizenga-voted-yea-passage-hb-4141-expanding-the-use-of-school-sinking-funds#.UpK5ICfNIhI

While we wait for the campaign language to roll out, let's rewind back to 2010:

Beaverton Rural Schools were hot after a 15-year bond extension. Our primary school is currently being considered for dormancy. If the last bond would have passed, we would be three years into an obligation to pay for a new gymnasium, 4 new class rooms, a new parking lot, new security system, and a new secure entrance for a school building not occupied.....

Please step into the way back machine link below:

http://www.gladwinmi.com/opinions/letters-to-the-editor/article_5017edd9-3ea9-5eff-9db1-ad8e93d9f01d.html?mode=jqm

Education should always be the primary focus along with a community obligation to maintain our investment in local school district infrastructure.

Dec. 6 update

There was a public presentation of the school finance status and why a bond extension may be the only way our school system may survive the increased mandated costs, declining enrollment, and debilitated infrastructure we have currently.

Want to see the video for yourself, click the link below:

There were 45 bodies in the BRS media center that heard the presentation given by our superintendent Susan Wooden that followed the B1 committee slide show. They obviously put considerable effort into the project, but as always - closer examination is crucial.

Sometimes crisis situations bring opportunity. And if we're gonna borrow our way out of danger, we might as well get some comfort out of it in the process.

Thus Exibit A:

There is a citizen committee (comprised of more than 45 people, we are told) that are meeting to try and come up with a plan that the voters might accept. The purpose of the survey above is to get community feedback and to build the model from those surveys that will end up being the bond extension request we will see on May 6. The results of the surveys received and the input from the B1 committee determine the "SCOPE" that is turned into the State.

The idea is to solicit the services of a well known construction management firm with expertise in navigating the school bond / construction scenario. The budget numbers from the survey may be inflated we are told, but any portion that comes in under budget will allow the remaining proceeds to be moved to a different project or enhancement so the SCOPE in a sense is not concrete. The term used in 2010 was "GREEN CONCRETE".

The construction management company makes its money from a percentage of total project cost. We know from the last bond extension request in 2010, that the Construction management fee may not be revealed until after the ballot initiative is passed. It is confusing why our school leadership would sign on to an open-ended agreement with a construction management firm until after the school bonds are sold, but the concept was not questioned last time.

Enter Exhibit B:

We can only assume since the entire sum of of bond sale money will be utilized, the actual fee of the construction management firm is not necessary. Quite possibly the mindset is, "They'll tell us when we are out of money." Hard to say, but we have been told that the management fee runs between 5-7 percent. There has been a request that that fee be addressed before a commitment.

The sales pitch once again is on financial necessity. The B1 did a good job of creating a power point presentation explaining the dire position of the school district, how we got there, and the repercussions of missing what they term a "once in a life time opportunity."

For some of us, that is a correct assessment. The proposed language right now is a 30-year extension. many on the B1 may not be with us when the bond sale is satisfied in the year 2044.

The committee is focusing on not increasing the rate at which citizens in the district are taxed.

The millage requested will be 1.35 on a district valuation of 335 million dollars. But to get the 9 million desired, the term is estimated at 30 years.

The discussions on immediate infrastructure deficiencies have been circulating for years, and it should be fairly safe to say that a community investment of this magnitude - which includes our school buildings and grounds - needs to be maintained. Keep in mind that the school funding levels are supposed to cover the cost to operate all functions of our school district, all appurtenances and aspects. None the less, we don't have the money in our fund equity to pay for major repairs like roofs and asphalt repairs. How ever that system failed, we are here today and it needs addressed.

There are disagreements on how the major issues should be addressed, but few disagreements that the issues NEED addressed, the most notable would be the the terms in years and interest accrued.

The problem with a long term obligation being proposed is evident with the following slide from the presentation.

Exhibit C:

If we look at the graph, in 2010-11 _ if you divide the red expense column by the number of students, you get a cost per student of $8507.00. Then if you go to 2014-15, where it is projected we will be a deficit district, the cost per student jumps to $9210.00. If the cost per student was maintained from 2010, this graph would look much different. We'd actually have a small surplus.

I would say the increased costs are likely tied to labor, and Compton admitted that the state-mandated pension contribution has risen considerably. A 30-year bond extension will have little affect on the health of the school if the cost per student continues to climb and the student population continues to fall.

It is understood that a financial infusion should buy time to allow the school district to make the cost per student match revenue, but we really do need to hear how they propose to do that or the bond extension is a non issue.

We as a community will end up with more public debt, an unsustainable school budget, some nice new short term amenities...but still on the road to insolvency.

When the City of Detroit found their public obligation outward curve model of sustained growth starting to bend inward and contracting. Their leaders chose to borrow, to sell bonds to maintain the status quo, or at least to prolong what ended up being the inevitable - Detroit was beyond bailing out.

Our economic system, love it or hate it, is built on growth - population growth, job growth, and increasing value of property. When economies contract, it is devastating to a fixed government model with bureacratic mandates. Ask our county government how the minefield of attrition is plotted. It is very frustrating.

But every generation has to rely on the adults in the room to protect the kids.

Sometimes I wonder if we deliberately ignore that our good intentions tend to hurt the next generation we purport to love.

Example:

Today we go to the community with a proposal that "does not raise taxes" and has "no additional cost to tax payers...."

Enter Exhibit D:

We have the luxury of going to the public with this language. But consider the following implications.....

How many items on the survey have a 30 year life expectancy?

Buses, computers, security equipment, asphalt, roofs.....

Kids in tenth grade today, if they decide to reside in Beaverton, will be on the hook until they are in their mid 40s. And all the buses, computers, security equipment, asphalt, and even roofs will need replaced again.....

Will the future school leadership be able to come to those future folks and say that we have a once in a lifetime opportunity that does not raise your taxes or cost your community any more money? It is a concept that is repetitive in local, state, and federal governments. We escape discomfort by passing it to future generations.

We should be aware of this problem by now. And if regular thinking folks don't look into their babies eyes and look down the road instead of in front of their feet, the bubble will burst again.

We had a housing bubble of easy credit blow up - and it was devastating. We have an impending education bubble of easy money. With job prospects few for our youth, there will be many defaults. With the local governments selling bonds to stave off disaster, we are looking at problems ahead like our warning beacon: DETROIT, MICHIGAN.

We don't have to use the old play book and follow the Pied Piper out of town. We have the power of history, and the world's biggest library piped into most homes. WE CAN research these issues.

Our immediate needs can be addressed through a sinking fund approved by the voters. A sinking fund - as we stated before - will save a tremendous amount of interest.

Our most recent district valuation is approximately 335 million dollars.

Enter Exhibit E from our Equalization Department:

Think about our immediate needs to push the district back onto the tracks - 1 mil would generate 335K dollars. 2.8 would net over 900K per year. INTEREST FREE. And it wouldn't cost our kids one cent. With no prevailing wage requirements.

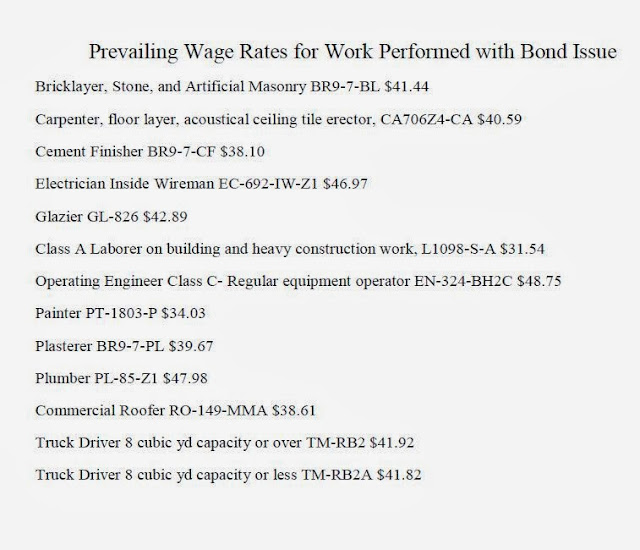

Now other things to consider with the bond extension: When we sell bonds the state has prevailing wage mandates. Those mandated labor costs do not match our small community demographics. And really isn't fair when you consider the projects that are being requested be completed out of necessity and emergency. The repairs need to be done as economically as practical.

Exhibit F:

Nobody would begrudge a decent wage, but state mandates in a crisis situation don't set will with tax payers.

Now considering crisis - that is the basis of this request again. Just like it was in 2010. Also, the time frame for decision is compressed again. We have to formulate a plan and submit it by the end of December.

Let me tell you, snap decisions around the Christmas season cannot end well!

There was mention of an extension of time and we fully encourage the B1 and our board to take heed.

At the time of this writing, everything is on the table. We are told that the survey helps the B1 determine what the public could tolerate as far as a ballot request. IT IS GREATLY ENCOURAGED THAT EVERYONE TURN IN A SURVEY to:

Susan Wooden

Beaverton Rural School Superintendent

swooden@beavetonruralschools.com

The survey should have been put out much earlier. As well as been sent home with students, and put in the paper. This is a district-wide issue, and the hesitance by our school to get information out early is troubling.

I feel the crisis situtation is being used as leverage to accommodate unecessary expenditures. We must separate apples from oranges when we consider the very information that our acedemic leaders are offering us. If the projections are accurate that we will be losing 40 students per year, the goal is to decrease debt, not take on a generational burden.

There is an open invitation to join the B1 citizen committee and help formulate the plan going forward. I have taken on that challenge. Will you?

We will be following the Bond request closely and reporting as information is presented.

Beaverton Rural Schools Website: http://www.brs.cgresd.net/

No comments:

Post a Comment